A statement is a tool used in financial analysis that helps simplify and compare economic data. Instead of presenting raw numbers, it displays each item. For example, in a common-size income statement, each expense is shown as a percentage of total sales. Similarly, in a standard size balance sheet, each asset, liability, and equity item is expressed as a percentage of total assets.

This format facilitates the analysis of a company’s performance over time or the comparison with other companies, regardless of their size. It highlights trends, strengths, and weaknesses that might not be obvious in traditional financial statements. For investors, analysts, and business owners, common-size statements provide a clearer picture of how resources are being utilized and where improvements can be made.

By removing the impact of size differences, these statements enable more accurate benchmarking and informed strategic decision-making. Whether you’re running a small business or analyzing a large corporation, understanding standard-sized financial statements can help you make more informed and confident financial decisions. It’s a smart way to turn complex financial data into meaningful insights.

What is a Common Size Financial Statement?

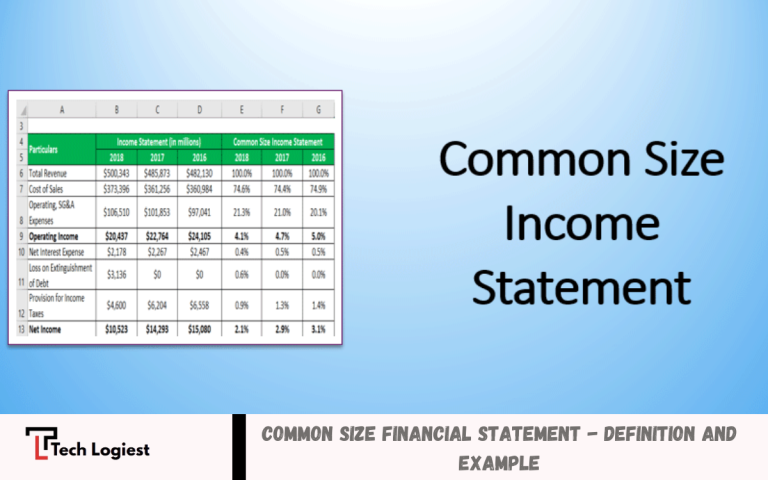

A Common Size Financial Statement is a type of financial report that shows each line item as a percentage of a key total. This makes it easier to compare financial data across different periods or between companies of various sizes.

For example:

- In a common-size income statement, all items (like cost of goods sold, operating expenses, and net income) are shown as a percentage of total sales.

- In a common-size balance sheet, each asset, liability, and equity item is expressed as a percentage of total assets.

This format helps you quickly see how much of a company’s resources are going toward specific areas. It removes the effect of company size, making it perfect for comparing two businesses, even if one is much larger than the other.

Why Use Common Size Financial Statements?

Common-size financial statements are used because they simplify, clarify, and enhance the effectiveness of economic analysis. Instead of focusing on raw numbers, they display each item as a percentage of a key figure, such as total sales or total assets. This percentage format enables users to quickly understand how a company allocates its resources, generates revenue, and manages its finances.

Here are some key reasons to use common-size statements:

Easy Comparison:

- They enable easy comparison between companies of different sizes or across different periods, even when the actual numbers differ significantly.

Trend Analysis:

- You can spot trends more easily—like rising expenses or declining profit margins—by comparing percentages year over year.

Better Decision-Making:

- Investors and managers can make more informed decisions by clearly seeing which areas of the business are growing or shrinking.

Benchmarking:

- Common-size data enables businesses to compare their performance with industry standards or those of their competitors.

Simplifies Complex Data:

- Turning prominent figures into percentages makes reports easier to read and understand, especially for people without a financial background.

Common-size financial statements turn complex financial data into clear insights that support more intelligent business decisions.

Read Also: What Is a Business – Understanding Different Types and Company Sizes

How to Prepare a Common-Size Financial Statement

Preparing a common-size financial statement is a simple yet powerful way to analyze and compare financial performance. Here’s a step-by-step guide to help you create one:

Choose the Financial Statement

Decide whether you’re working with an income statement or a balance sheet.

- Use total sales/revenue as the base for the income statement.

- Use total assets as the base for the balance sheet.

Identify the Base Amount

The base amount is the figure you will use to calculate all percentages.

- Income Statement: Base = Total Sales

- Balance Sheet: Base = Total Assets

Convert Each Item into a Percentage

Use the following formula for each line item:

Percentage = (Line Item Amount ÷ Base Amount) × 100

For example:

- If total sales = $100,000

- And cost of goods sold = $60,000

- Then COGS as a percentage = (60,000 ÷ 100,000) × 100 = 60%

Presented in a Common Size Format

Please create a new version of the financial statement that displays each line with both the actual value and its corresponding percentage. This gives a clearer view of economic performance.

Analyze the Results

Look for high or unusual percentages to identify strengths, weaknesses, or areas for improvement.

Common-size statements are beneficial for tracking changes over time or comparing them with competitors, making them a valuable tool for financial analysis.

Benefits of Using Common Size Analysis

Common-size analysis offers several advantages that make it a valuable tool for financial planning, comparison, and informed decision-making. Here are the key benefits:

Easy Comparison Between Companies

Common-size statements express figures as percentages, allowing you to compare businesses of different sizes. Whether a company makes $1 million or $10 million in sales, you can still compare how it allocates expenses.

Trend Analysis Over Time

By comparing common-size statements across multiple periods, you can identify trends, such as increasing costs, shrinking profit margins, or changes in asset structure. This helps identify patterns that require attention.

Simplifies Complex Data

Instead of focusing on raw numbers, common-size analysis simplifies the financial data into easy-to-understand percentages. This makes reports more accessible to non-financial users, like small business owners or new investors.

Highlights, Strengths, and Weaknesses

You can quickly see where a company is overspending or underperforming. For example, a high percentage of sales spent on marketing might suggest either strong promotion or excessive cost.

Supports Strategic Decision-Making

When management sees the percentage of income allocated to different areas, it becomes easier to cut costs, improve operations, and make more informed budget decisions.

Common-size analysis turns detailed financial statements into clear, comparable, and actionable insights.

Key Insights You Can Gain from Common Size Statements

Common-size financial statements go beyond the numbers — they help reveal the story behind a company’s financial health. Here are the key insights you can gain:

Cost Structure Understanding

You can see exactly how much of your revenue is allocated to various expenses, such as the cost of goods sold (COGS), salaries, rent, or marketing. For example, if 70% of sales go to COGS, your profit margin might be too thin.

Profitability Trends

By reviewing common-size income statements over time, you can track changes in profit margins, operating costs, and net income. This helps identify whether the business is becoming more or less efficient.

Efficiency in Asset Usage

In a common-size balance sheet, you can analyze how assets are distributed. A high percentage of current assets may suggest liquidity, while a significant amount tied up in fixed assets could signal inflexibility.

Debt vs. Equity Mix

It illustrates the proportion of the company’s financing that is provided through debt versus equity. This helps assess financial risk and stability — a high percentage of liabilities may indicate higher financial leverage.

Year-to-Year or Peer Comparisons

Common-size statements help you compare financial performance over time or against industry benchmarks. This makes it easy to see where your business stands in relation to competitors.

These insights make common-size analysis a powerful tool for making more informed business decisions and planning for the long term.

Frequently Asked Questions

Can small businesses use common-size statements?

Yes! They are invaluable for small businesses to track spending patterns, control costs, and compare their performance with that of larger competitors.

Is standard size analysis the same as vertical analysis?

Yes, “common size analysis” is another name for vertical analysis—analyzing financial statements by expressing items as percentages of a base.

Can I use standard size analysis for multiple years?

Yes. Comparing common-size statements across years helps identify trends, growth, or areas that need improvement.

What software can help create common-size statements?

Programs like Microsoft Excel, Google Sheets, QuickBooks, and other accounting software often include tools or templates for standard size analysis.

What are the limitations of standard size analysis?

While helpful, it doesn’t display absolute values, doesn’t account for inflation or market conditions, and may not provide a complete financial picture on its own.

Conclusion

Common-size financial statements are a simple yet powerful tool for understanding a company’s economic performance. By converting each line item into a percentage of a base figure—like total sales or total assets—they make it easier to compare financial data across periods or between businesses of different sizes. This approach helps uncover valuable insights such as cost structure, profitability, asset usage, and economic stability.